Why Do I Pay The HST Rebate Up Front On Rental Properties?

Once you close on the property and have a tenant sign a lease, you would be eligible for a $18,000 new residential rental property rebate. Instead of taking a mortgage out for $269,000 and then figuring out how to use your rebate money to pay down the mortgage principal, you could instead borrow $18,000 via credit card or line of credit (LOC.

The Best Tax Benefits, Rebates and Grants You Can Get for Renovating in Canada, by Province

The HST Rebate is calculated as Ontario home buyers may be eligible for a credit of 75% of the Ontario portion (8%) of the HST and 36% of the federal portion (5%) of the HST paid. For example, buyers of a new $600,000 home would pay slightly more than $69,000 in HST. 75% of the provincial portion of the HST, which is approximately $42,500, is.

HST Rebate Ontario Services New & Custom Homes, Condos & Rentals

If you recently bought a newly-built home or invested in renovations, whether as your principal residence or as a residential rental property, you may be entitled to an HST Rebate. Contact us for a complimentary assessment of your HST position. Call us at 1-888-544-5467 today!

GST HST New Housing Rebate And New Residential Rental Property Rebate

Most importantly, Rebate4U can accurately calculate the HST new residential rental property rebate. This allows the NRRP application, along with supporting paperwork, to comply with all of the pre-requisites of the process. As a property owner or landlord, you would be required to keep copies of all completed forms, original receipts, invoices.

Why Do I Pay The HST Rebate Up Front On Rental Properties?

Copy of your deed/transfer. Contact us today at care@dashpm.ca or 416-222-6175 ext. 2026 to start your rebate amount quickly. Use our calculator to find out whether you are eligible for a GST/HST New Residential Rental Rebate, you can quickly get up to $30,000.

New Residential Rental Property Rebate Revenue District

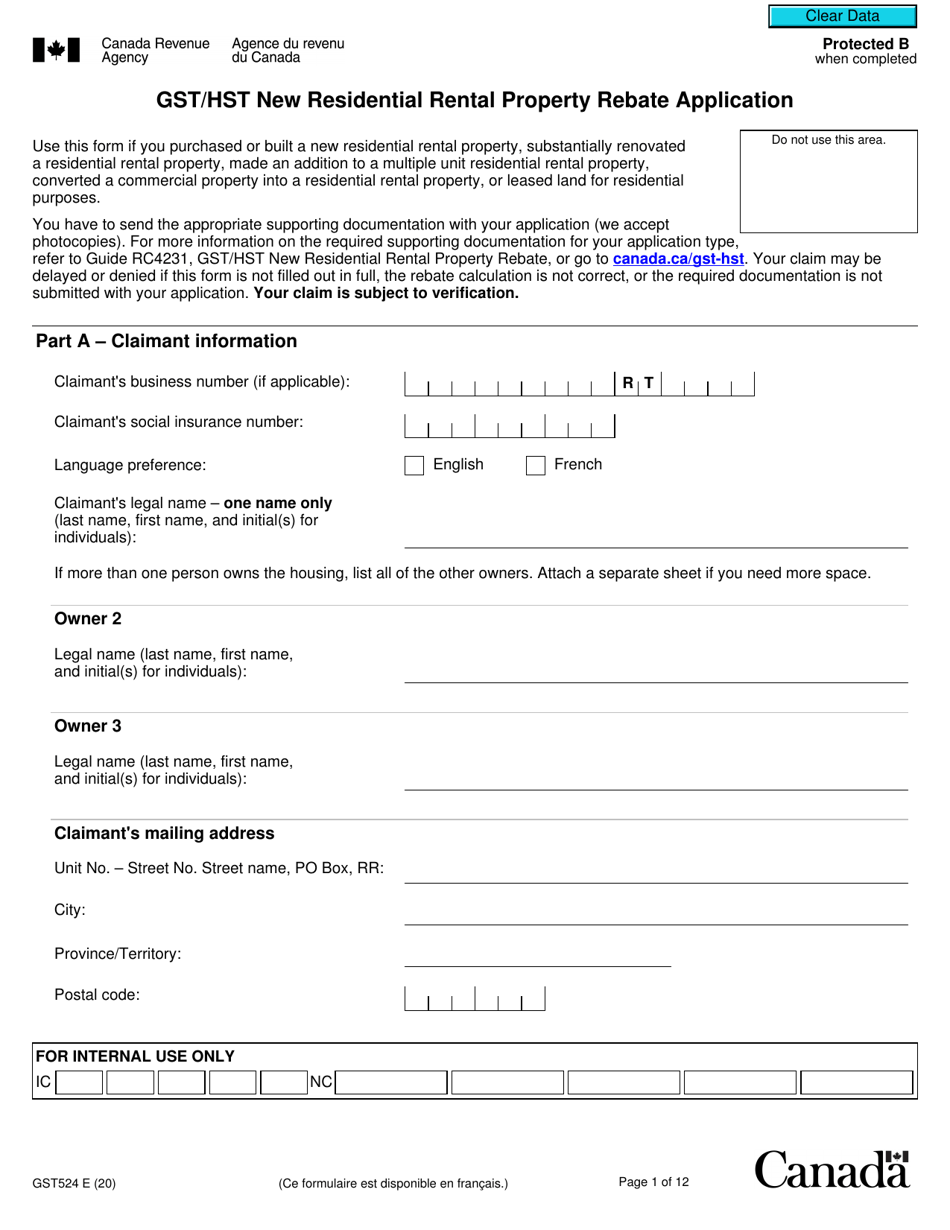

To claim the Ontario new residential rental property (NRRP) rebate for rental properties located in Ontario, all eligible claimants, regardless of the application type, must fill out parts A, B, C, and F of Form GST524, GST/HST New Residential Rental Property Rebate Application, and Form RC7524-ON, GST524 Ontario Rebate Schedule.

Maximizing Your HST Rebate In 2023 5 Best Tips and Strategies

Issue 2023-30. In brief. On September 14, 2023, the Department of Finance provided some additional information in its Backgrounder 1 relating to the federal government's announcement to enhance the GST rental rebate. The enhanced rebate will relieve builders of their obligation to pay the federal component of GST/HST on newly constructed multi‑unit rental properties.

TAX REBATE BLOG SERIES GST HST New Housing Rebate

For residential rental properties located in Ontario, you may be eligible to claim the Ontario NRRP rebate if you are not eligible to claim the NRRP rebate for some of the federal part of the HST only because the fair market value of the qualifying residential unit exceeds $450,000. For more information, see GST/HST Info Sheet GI-093, Harmonized Sales Tax: Ontario New Residential Rental.

The Benefits Of Purchasing A New Residential Rental Property

The enhanced rebate would be equal to 100 per cent of the provincial portion of the HST, with no maximum rebate amount. In the example of a two-bedroom rental unit valued at $500,000, the enhanced Ontario HST New Residential Rental Property Rebate would deliver $40,000 in provincial tax relief.

What Is The Maximum HST Rebate On New Homes? My Rebate

The much-anticipated Bill C-56, Affordable Housing and Groceries Act, which received first reading in the House of Commons on 21 September 2023, includes amendments to the Excise Tax Act to implement certain enhancements to the GST new residential rental property rebate first announced by Prime Minister Justin Trudeau on 14 September 2023.

New Condo HST Rebate Sproule + Associates

Fill out this form if you purchased or built a new residential rental property, substantially renovated a residential rental property, made an addition to a multiple unit residential rental property, converted a commercial property into a residential rental property, or leased land for residential purposes and you want to claim the GST/HST rebate.

New "GST Withholding" regime on "new" residential property transactions ‒ will you be ready

The federal GST/HST New Residential Rental Property Rebate ("GST/HST NRRP rebate"), which covers some of the GST or the federal part of the HST, is available to buyers who: (1) have paid the GST/HST on the purchase of a newly constructed residential complex that is, or contains at least one "qualifying residential unit"; and (2) are leasing the complex or units in the complex to.

GST/HST New Residential Rental Property Rebate

If you recently bought a newly-built home or invested in renovations, whether as your principal residence or as a residential rental property, you may be entitled to an HST Rebate. Contact us for a complimentary assessment of your HST position. Call us at 1-888-544-5467 today!

(HST Rebate) the New Residential Rental Property Rebate

Since the Ontario rebate is capped at a maximum property value of $400,000, most properties will receive a maximum refund of $24,000. If you receive the rebate for the new residential rental property and subsequently sell it within one year, CRA may ask you to repay the rebate unless the property is a principal residence for the new buyer.

TrevorKLaw GST/HST Rebates for New House or Condo Purchases

How to Claim the NRRP Rebate. You can make an application within two years after the property closes or sells. All applicants must complete Form GST524, GST/HST New Residential Rental Property Rebate Application. Depending on the specific situation under which you qualify, you may need to complete additional forms and applications.

Form GST524 Download Fillable PDF or Fill Online Gst/Hst New Residential Rental Property Rebate

Rebate Schedule and Guide RC4231, GST/HST New Residential Rental Property Rebate. If you are not entitled to claim a GST/HST new residential rental property rebate, but you are entitled to claim a provincial new residential rental property rebate, fill out parts A, B, C, and F of this form (do not fill out parts D and E). Then fill out

.